Is The Swimming Market Too Small For Entrepreneurs?

Guest Commentary by Nico Gimenez @nicomg17

Some people think the swimming market is too small to build an investable business. Before my co-founders and I decided to develop a swim product, we explored this hypothesis and concluded that swimming is an underrated niche within the broader fitness market. That said, the goal here is to (i) provide perspective on the number of core swimming participants, and (ii) shed light on the sport’s growth domestically.

Rather than rattling off the largest participation numbers we can find online (meaningless without context), we make an “apples to apples” comparison between swimming, running, and cycling. Why? Because when you ask someone if you can build an investable business in running, the response is, “of course, look at MapMyRun.” What about cycling? “Of course, look at Strava”. Swimming? “Um…isn’t the market too small?”

1. NUMBER OF CORE PARTICIPANTS

While swimming may not be America’s most popular sport, it’s sizable and it’s increasing in popularity. In England and Australia (figures below), as well as other international countries, swimming is more popular than running and cycling.

Note on figures:

- – Represent “core” or “regular” participants, which means they participate in thesport 50+ times per year (~1/week). Focus is on these participants because theyare most likely to spend on new technology.

- – Based on participation, not dollar spend. But, like runners and cyclists, mostswimmers are affluent hobbyists.

U.S. Core Participants

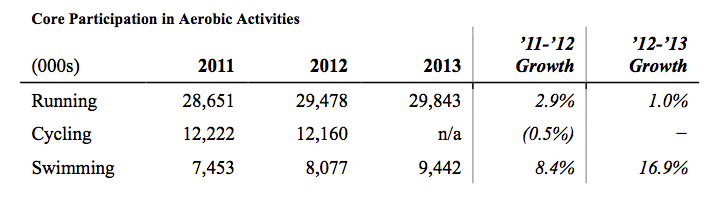

Running dominates in the U.S., and the disparity between swimming and running participation is not as large as you might think. In fact the number of core swimmers is ~1⁄3 the number of core runners. Swimming is not too far behind cycling, and growth for the sport over the same time period is much stronger than both cycling and running.

Photo Courtesy: 2013 SFIA Participation Topline Report, 2014 SFIA Swimming for Fitness Single Sports Participation Report, 2014 SFIA State of the Sport: Running Industry Report

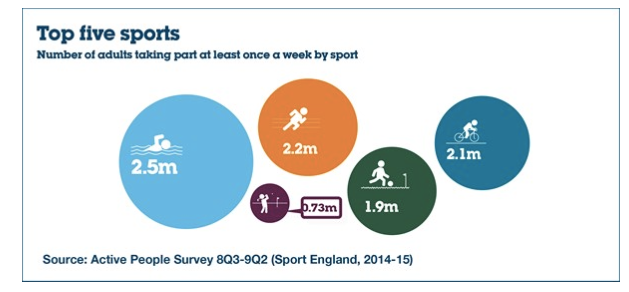

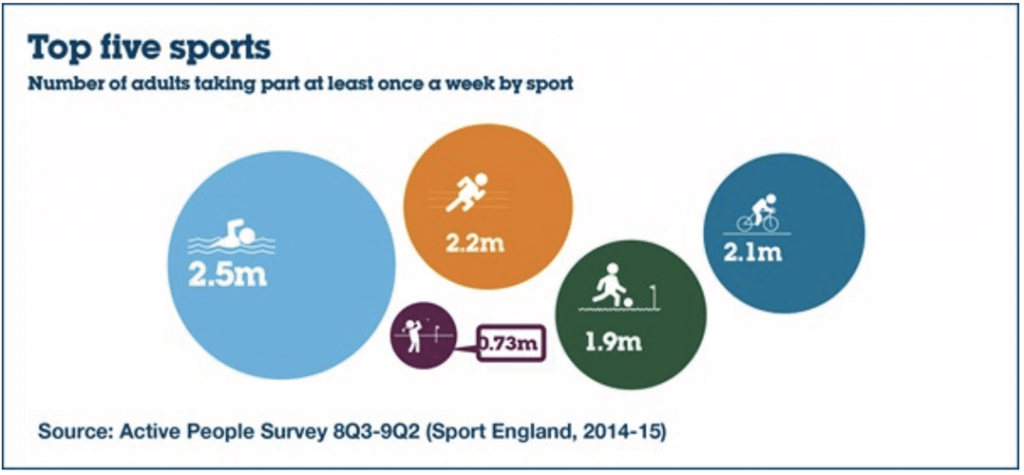

England Core Participants

In England, recent (2014-15) studies illustrate swimming’s dominance amongst adults participating in sports weekly:

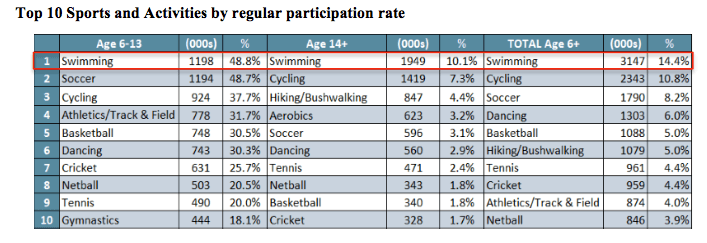

Australia Core Participants

In Australia, the latest (2014) National Sports Participation report from Roy Morgan Research shows that swimming is the most common sporting activity:

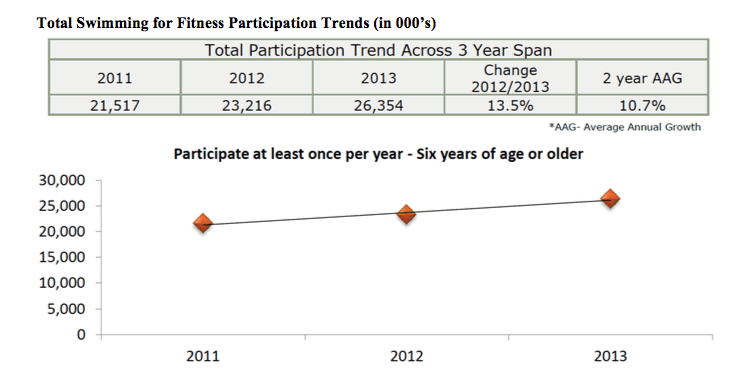

2. U.S. GROWTH

In its 2015 Participation Report, the Physical Activity Council (PAC) conducted research on which sports interest non-participants (those who don’t yet participate in the sport). What they found was that most people want to try swimming. Amongst sports including running, cycling, basketball, soccer and others, swimming ranked #1 or #2 for every age group:

Ages 6-12: #1

Ages 13-17: #2

Ages 18-24: #2

Ages 25-34: #1

Ages 35-44: #2

Ages 45-54: #1

Ages 55-64: #2

Ages 65+: #1

Not only was swimming the “most aspirational sport” in 2014, but also from 2011-2013. We believe the strong interest from non-participants in those years helped drive the sport’s total growth (as seen on graph below). Therefore, my co-founders and I find the above 2014 results encouraging, and we believe they are indicative of continued future growth.

You’ve seen the numbers, now for what we think this means…

Swimming is a great way to enter the fitness market. The sport is relatively neglected by technology companies compared to running and cycling, which consequently lowers the barriers to entry and leaves a prospective user base eager for new technology. With the growing number of participants in the U.S., strong presence overseas, and an affluent demographic, swimming is not a market fitness startups want to ignore. Based on the participation figures displayed above, ignoring the swimming market means ignoring over 20% of the mainstream endurance sports market.

On a personal note, our team at Commit greatly enjoys working with swim coaches and athletes as we develop our product. Individuals in this sport are passionate, diligent, and excited about new tools that can make the sport faster. So, for anyone looking to introduce innovative ideas to swimming, don’t let someone else’s perceived size of the market prevent you from doing so!

The above commentary is the opinion of the author and does not necessarily reflect the views of Swimming World Magazine nor its staff.

- 2020 Holiday Gift Guide by Swimming World

- 2022 Holiday Gift Guide by Swimming World

- 2022 Prep School Directory by Swimming World

- 2022 Swim Camp Directory by Swimming World

- American Swimming Records: Long Course Meters

- American Swimming Records: Short Course Meters

- American Swimming Records: Short Course Yards

- Aquatic Directory: Spectrum Aquatics

- Cart

- Checkout

- Contact Us At Swimming World

- Donation Confirmation

- Donation Failed

- Donor Dashboard

- Every Child A Swimmer

- FREE 90 Days

- ISHOF – Swimming World Early Bird Renewals

- ISHOF – Swimming World Magazine Renewals

- ISHOF One in a Thousand Club

- Login or Join

- Maxime Grousset Rattles 100 Free Rankings With 47.62 Blast In Rennes; Three In Three For Leon Marchand

- My Downloads

- My Swimming World Account

- My Swimming World Account – Redirect To New Login Page

- NAIA Swimming Records

- NCAA Division II Swimming Records

- NCAA Division III Swimming Records

- NCAA Men’s Division I Swimming Records

- NCAA Women’s Division I Swimming Records

- NJCAA Swimming Records

- Olympic Swimming Records

- Post a Job

- Prep School Directory

- Shop

- Swimming Jobs

- Swimming Resource Guide

- Swimming World Archive

- Swimming World Award Honorees

- Swimming World Media Kit

- Swimming World Partners And ISHOF Sponsors

- Swimming World Swim Camp Directory (All Listings)

- Swimming World’s Record Book

- Terms

- The Who’s Who Aquatic Directory For The Industry

- USA High School National Records

- World Junior Records in Swimming: Long Course Meters

- World Swimming Records: Long Course Meters

- World Swimming Records: Short Course Meters

- zz(SW Carousel)

- zz(SW Category Double)

- zz(SW Category Single)

- zz(SW Category Triple)

- zz(SW Posts w Ads)

- zz(SW Recent Comments)

- zz(SW Recent Posts)

- zz(SW Search)

- zz(SW Slider)

- zz(SW Weekly Poll)